By Mike Maharrey, Money Metals Exchange

How you read the August Consumer Price Index (CPI) report is a matter of perspective. There is some good news in there for the optimist. There's some bad news in there for the pessimist. And there's a lot of "uh-oh" for the realist.

The CPI report was certainly good enough to keep the Federal Reserve on track for a rate cut this month. But there was just enough bad news buried in the report to crush hopes for a bigger 50 basis point cut.

The CPI Data

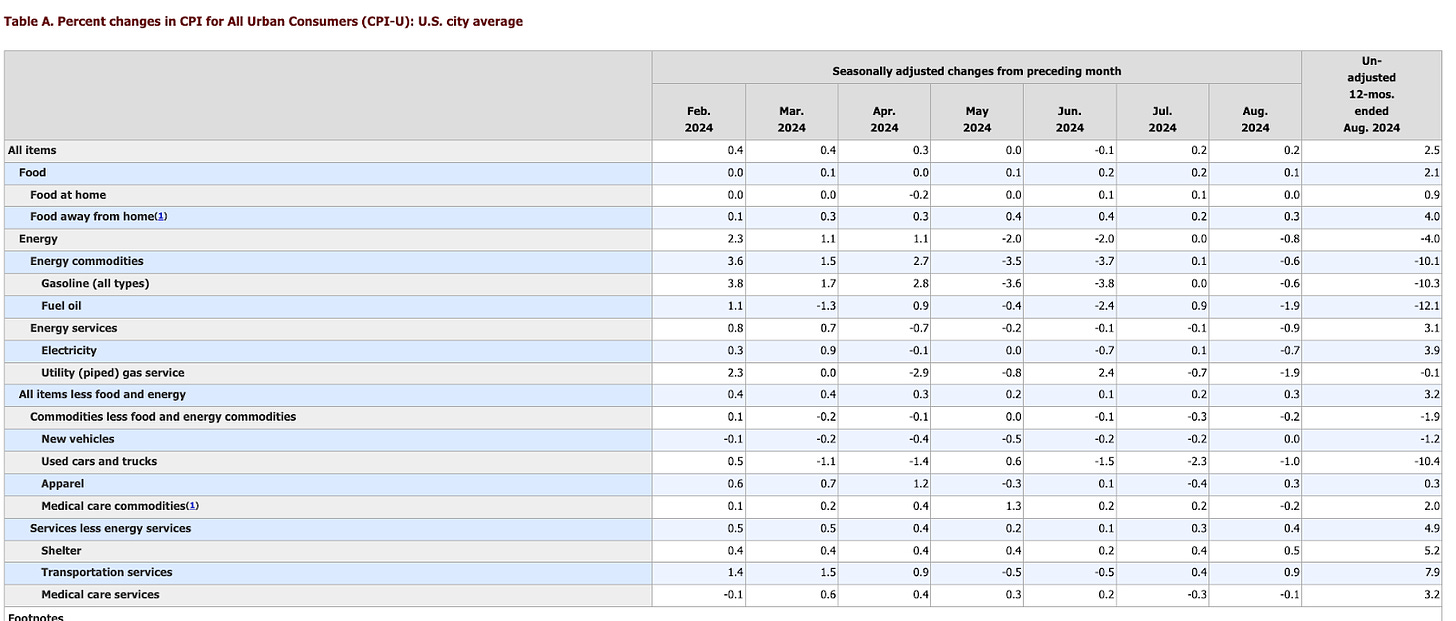

On an annual basis, the CPI fell to 2.5 percent, according to BLS data. That was a big decrease from 2.9 percent in July and the lowest annual CPI print since February 2021.

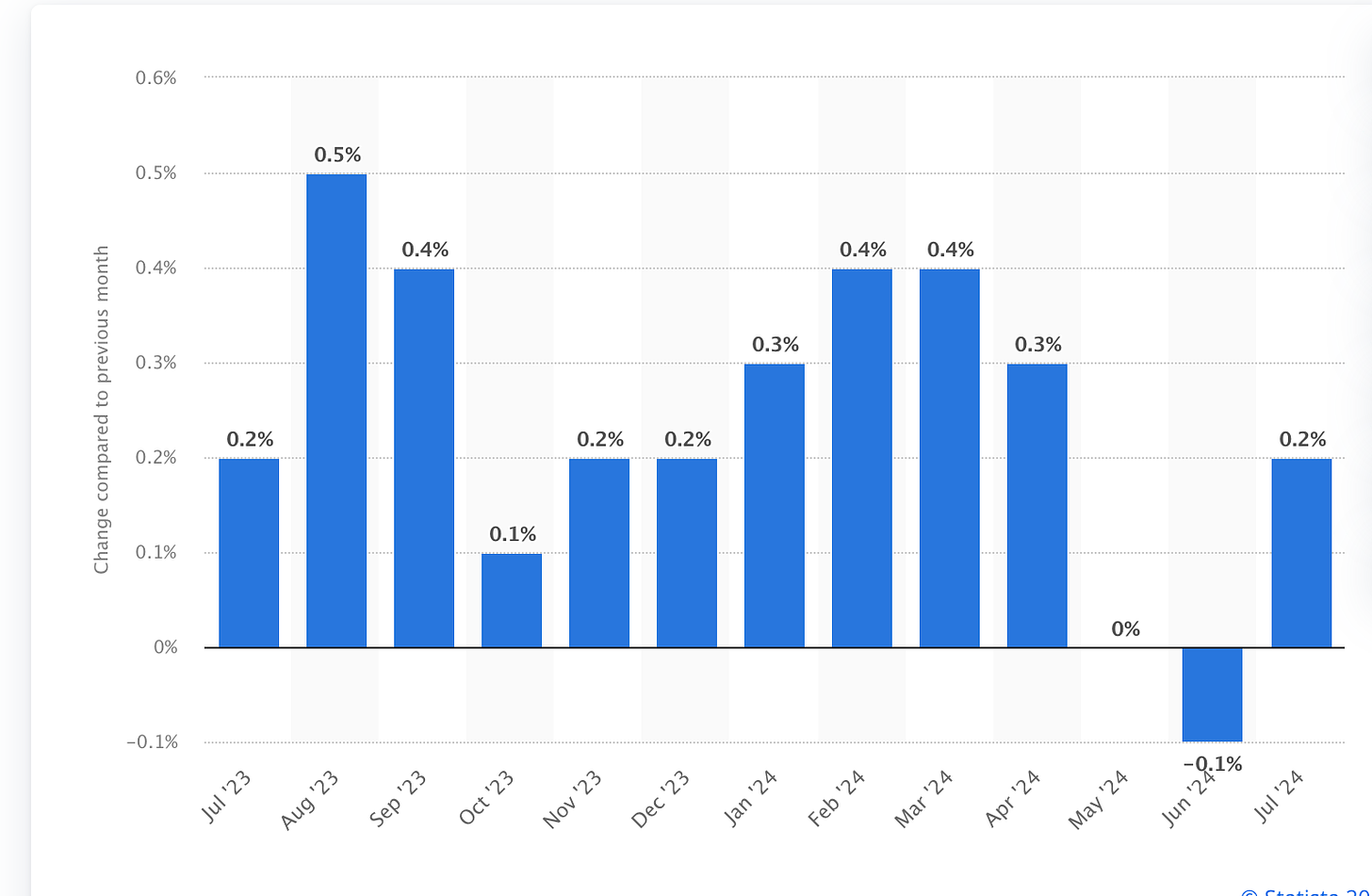

The significant drop in the annual number was partly a function of math. A big 0.6 percent monthly CPI increase in August 2023 fell out of the CPI calculation, pulling the 12-month average down.

On a monthly basis, prices rose by 0.2 percent, the same as in July.

Looking at the last 12 months, 0.2 percent is generally in line with the monthly CPI increase, with May and June as outliers.

When stripping out food and energy prices, the CPI report becomes much less sanguine. Core CPI rose by 0.3 percent month-on-month. On an annual basis, core CPI remains stubbornly high at 3.2 percent, well over the Fed’s mythical 2 percent target.

You should also always note that price inflation is worse than the government data suggest. The government revised the CPI formula in the 1990s so that it understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

Digging Deeper into the CPI Numbers

Falling energy prices are the primary factor driving CPI lower.

The overall energy index fell by 0.8 percent month-on-month and is down by 4 percent over the last 12 months. Gasoline prices dropped by 0.6 percent in August and fuel oil prices plunged by 1.9 percent.

Falling vehicle prices have also pushed overall price levels lower. This is likely a function of the fact that tapped-out consumers can’t afford to buy a car.

Other prices continue to rise. Shelter costs spiked by 0.5 percent in August. Food prices nudged up another 0.1 percent.

We’re also seeing a lot of price pressure in services, with “services less energy services” up 0.4 percent on the month. Service inflation continues to run at 4.9 percent on an annual basis. Core services accelerated for the second straight month, jumping to 5.0 percent annualized.

Real Inflation Numbers

Price inflation is a little bit like a toddler who is supposed to be taking a nap. He’s in the crib, but he’s not asleep. He’s just waiting for somebody to come spring him loose so he can wreak more havoc on the household.

Well, don’t worry little fella. Daddy is on the way.

CPI data tells how much the Bureau of Labor Statistics’ basket of goods increased. It doesn’t tell us anything about the root cause of price inflation – monetary inflation.

Keep in mind that inflation properly defined is an increase in the supply of money and credit. This ultimately drives prices higher than they otherwise would be. The CPI doesn’t measure inflation. It measures price inflation, a symptom of monetary inflation.

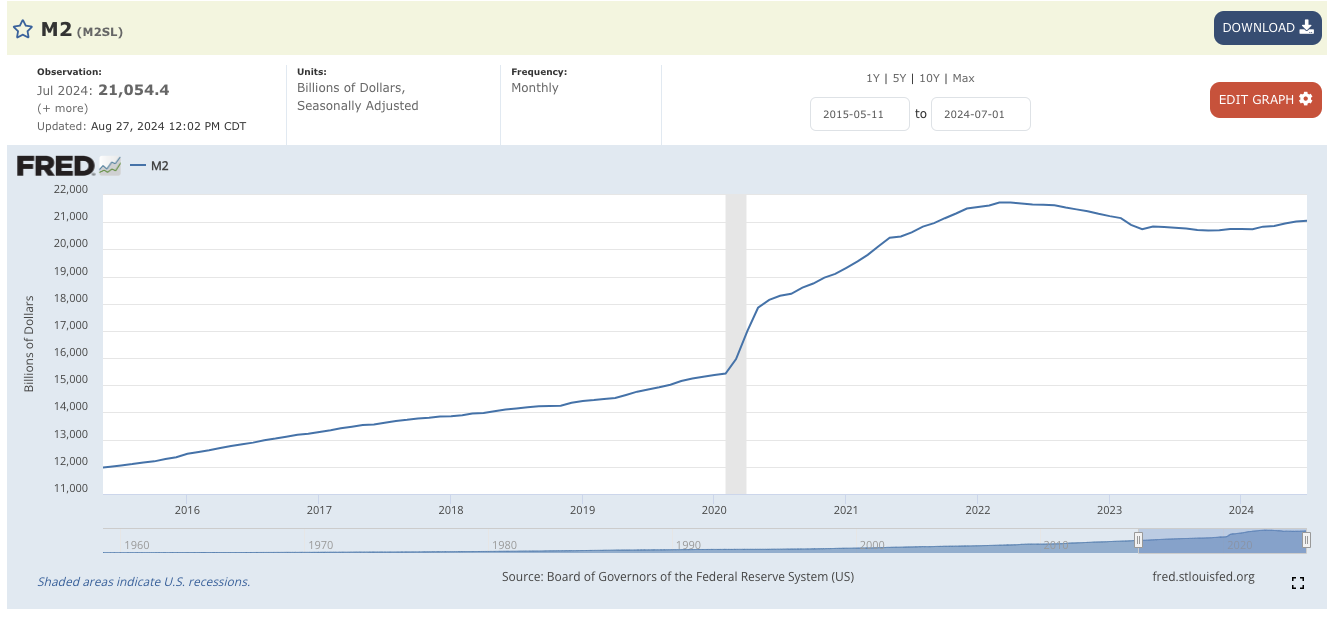

Looking at the M2 money supply, it is already going up, even before the Federal Reserve cuts rates. After bottoming in November 2023 due to the Fed’s relatively aggressive tightening cycle, the money supply began creeping up again early this year.

In other words, the central bank is already inflating.

In fact, the central bank already loosened monetary policy when it quietly announced that it would begin to taper balance sheet reduction in June.

The first rate cut will be the Fed’s second move as it withdraws from the inflation fight.

Keep in mind what this pivot actually means – the Federal Reserve is ramping up the inflation machine even as it declares victory over inflation.

The Markets Were Not Pleased

Even with the less-than-ideal CPI report, analysts still expect a rate cut at the next Fed meeting. The fed funds futures market prices an 85 percent chance that the FOMC will cut rates by 25 basis points.

But stock markets still threw a fit after the CPI data came out quickly selling off on the news (although they recovered later in the day).

Why the temper tantrum?

Because investors want more than 25 basis points. They were hoping for a half-percent cut.

As Principal Asset Management chief global strategist Seema Shah told CNBC, “This isn’t the CPI report the market wanted to see. With core inflation coming in higher than expected, the Fed’s path to a 50 basis point cut has become more complicated.”

She went on to say that the CPI report wasn’t “an obstacle to policy action,” but policy hawks on the FOMC committee will likely use it “as evidence that the last mile of inflation needs to be handled with care and caution,” and a reason to default to a 25 basis point cut.

Why are the markets so desperate for a big rate cut?

As Gold Newsletter publisher Brien Lundin put it, “The markets know that far deeper cuts are needed — and soon — to keep the economy afloat.”

That’s because an economy loaded up on debt and addicted to easy money simply can’t function in a higher interest rate environment.

The Federal Reserve is walking a tightrope without a safety net. It wants to keep price inflation tame enough so you don’t notice it, but it also knows it needs to create inflation to keep the economy running.

Only time will tell how that turns out.

Originally Published on Money Metals Exchange.